Launchpads are crowdfunding platforms for blockchain projects to raising money . They provide intermediary services to startups and investors. Investors put their money into the creation of a product or service at the development stage, and in return receive tokens — valuable digital assets that give shareholder rights. Tokens can later be exchanged for real goods or services — for example, listening to music recordings of your favorite artist — or used to buy features or access a closed location in a computer game. Both parties benefit: the crypto startup receives needed funding and continues to develop, and investors buy tokens at a price much lower than the market price, and if they wish, they can resell them for a profit. After the launch on the market, as new investors develop and appear, the profit of shareholders who invested in a startup at the launchpad stage grows.

Why Crypto Startups Need Launchpads and How They Work

Cryptocurrencies and NFT tokens are experiencing a boom in popularity today. However, both the creators and investors of crypto startups have a common pain — finding and placing a promising project on the network. A game, a cryptocurrency, a metaverse — there is a huge demand for a platform where everyone has an opportunity to promote a product, get detailed information about it, and buy, sell, or exchange tokens profitably. Launchpads became an innovative solution to resolve all these challenges. We understand how they work and why startups and investors need them so much, and we make an overview of the most popular launchpads in 2022.

What are launchpads?

The main task of launchpads is to ensure safety and security for their users. Therefore, they carefully screen both startups and investors (for example, by conducting a «know your customer» (KYC) process) before allowing them to participate, helping to build trust between the participants and reduce the likelihood of fraud.

There are different ways to raise funds and launch projects on the sites, hence the different types of cryptolaunchpads:

- sites for ICO (Initial Coin Offering) — used to sell project tokens for cryptocurrency or fiat currency. The first ICOs appeared in 2016 and were mainly deployed on Ethereum. Projects were created as blockchain analogy of an IPO, with the difference that cryptocurrency investors did not receive a stake in a blockchain startup or any other dividends or rights. ICO platforms today are unpopular and greatly distrusted by the crypto community due to frequent cases of fraud;

- IEO platforms (Initial Exchange Offering) — a mechanism for the initial sale of cryptocurrencies or tokens on centralised exchange platforms; exchanges have become intermediaries between developers and investors, in other words, they act as guarantors of the fulfillment of their obligations and protectors from fraud and speculation. In return, exchanges take commissions from users of the launchpad;

- IDO (Initial DEX Offering) platforms — sites for the initial offer of cryptocurrencies or tokens on a decentralised exchange; most IDO launchpads issue their own tokens, and if users want to participate in crowdfunding, they must have a certain amount of them;

- INO platforms (Initial NFT Offering) — an option to launch the first public NFT offer; INO launchpads are primarily used by musicians, artists, designers and other unique content creators, as well as their investors;

- IGO (Initial Game Offering) platforms serve, as the name implies, for the initial offer and crowdfunding of games, game NFTs, game metaverses, P2E projects and in-game utilities.

Who can participate in launchpads?

- Investors. Any owner of a Web3 wallet and cryptocurrency could potentially invest in a token.

In practice, not everyone is allowed to participate in the initial proposal. For example, in IDO, the number of project tokens is limited, and in order to fairly distribute them among investors, launchpads practice whitelisting. Every time, an investor must pass a casting call in such kind of list in order to participate in the IDO. If he is chosen, then the next step is for the investor to pass a KYC check, which is necessary in order to exclude the participation of bots, as well as investors from those countries where IDO is prohibited by law (USA, China, Hong Kong) and countries that are subject to OFAC sanctions ( Belarus, Zimbabwe, Iraq, Iran, Congo, Côte d'Ivoire, Cuba, Liberia, Myanmar, Sudan, North Korea, Syria,). Users from these countries receive Pending or Unverified KYC status.

Whitelisted investors who successfully pass KYC lock the amount they want to invest and then exchange tokens for new ones issued during the IDO of the project — they usually sell out in a few hours. To prevent one or two big whales from buying up all the tokens and becoming hegemonic investors controlling the project, DEX introduced a democratic lottery distribution system tokens between investors.

After the launch of the project, the value of the token grows and investors can resell their assets at a higher price.

2. Creators of cryptocurrency, NFT and other blockchain projects. Blockchain Games, DeFi, Art, and whatever comes to your mind from the world of cryptocurrencies — there are no format restrictions for projects that are on the lookout for sponsors on crypto launchpads.

For the exchange to approve the project and agree to place it on the launchpad, a startup must submit ready-made business plans and token economy models, as well as a development team, with a description of their experience and qualifications. The project is also expected to have the potential to be adopted and scaled in the market that could benefit the crypto community; the problem that the project solves, the goals and objectives along the way — everything should be reflected in the technical documentation, as well as on the startup website and social media profiles, where investors can find detailed information and news on the project. The existence of the site and long-running social media profiles also convince launchpad specialists and potential investors that the project is real.

Then the developers decide on the exchange on which they want to be placed, and submit an application there. If the experts approve the project, it goes to the launchpad platform and receives full exchange support: consulting services, marketing assistance and access to the community of investors from all over the world. This is how launchpads help projects with scalability: a popular exchange gives crypto startups unknown to the world access to millions of users from all over the world, and gives projects world-class liquidity along with trading pairs such as Ethereum / Bitcoin Cash.

Lastly, the project team launches its own cryptocurrency or token (with the help of a specialized application) and creates a pool of tokens — a place where investors pay in advance for their tokens (they will receive the tokens themselves after the end of the pre-sale). Initially, the creators offer tokens at a minimum price, which they usually increase; this so-called auction stimulates competition and as a result demand for the product. Once the initial offer is completed, the tokens go to the exchange for general sale.

Our case study on launchpad development

We share our experience in developing MetaPool launchpad

Which crypto launchpads are popular in 2022?

BSC PAD

The first fully decentralised IDO platform for the Binance Smart Chain, and by no means one of the most popular launchpads in existence. BSC Pad provides an opportunity for blockchain project developers to distribute their tokens, raise funds and build liquidity.

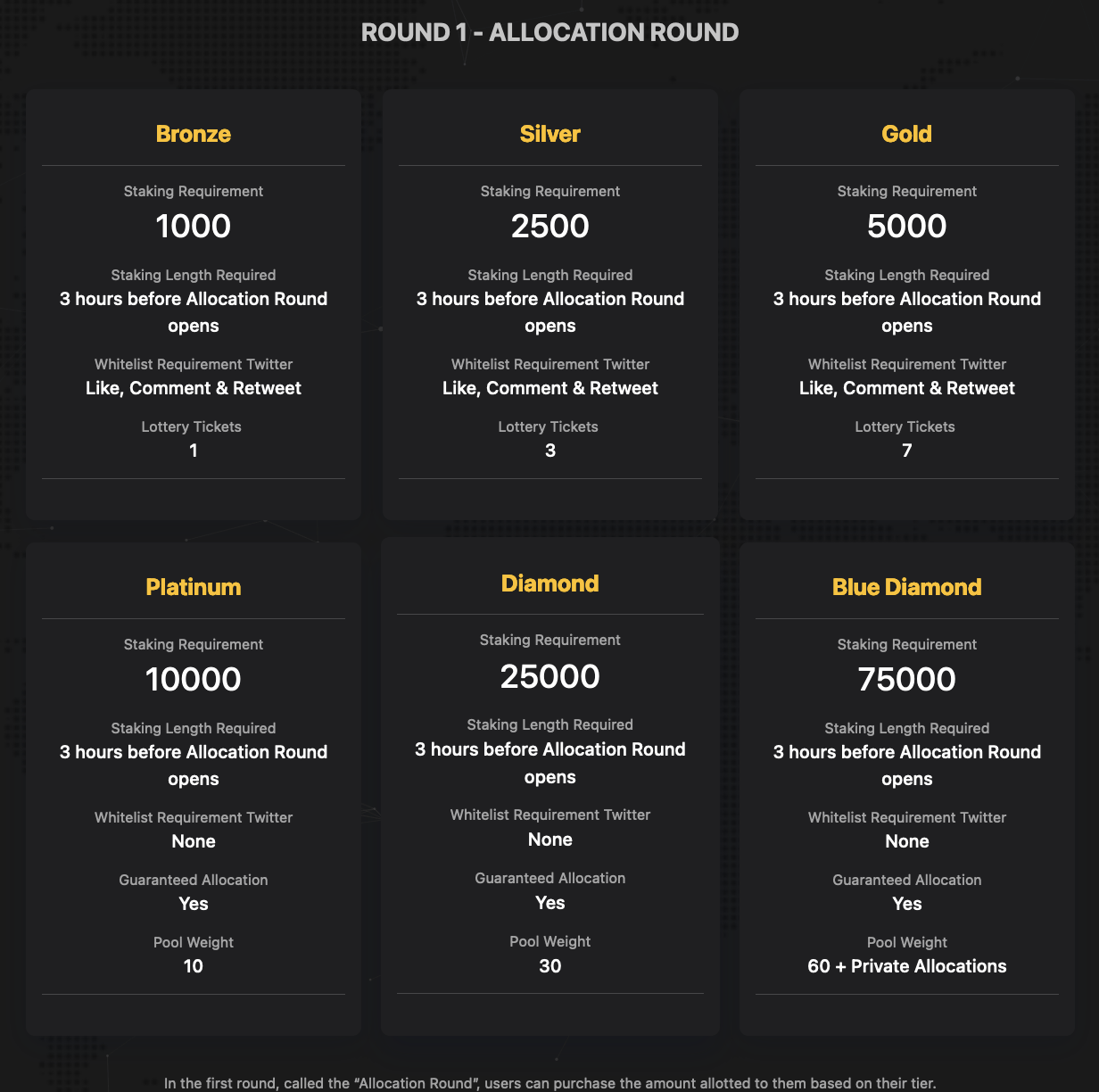

The platform's native token is called BSCPAD. Its owners can participate in IDO, and the more tokens they stake, the higher their ranking will be and they will receive more tokens. The minimum staking requirement is 1,000 BSCPAD (at a cost per platform token of $0.16 at the time of writing) and automatically assigns the owner a Bronze tier.

BSCPad is known for its special two-round project asset allocation system. In the first round, all users are guaranteed to receive tokens in direct proportion to their status and the amount of BSCPAD they hold. In the second round, all tokens remaining after the first round are sold on the basis of the FCFS (First Come First Serve) principle only to investors of guaranteed levels (this is Platinum and above). The amount of tokens they can purchase is determined by a formula based on their level. The second round is open until all tokens have been sold (usually a matter of a few minutes). IDO ends when all tokens are sold.

Below in the infographics there are the ranking levels of investors — participants in the first round.

So far, 69 projects have been launched through BSCPad, raising $16 million.

Polkastarter

Polkastarter is a large launchpad platform based on the Polkadot blockchain that uses cross-chain bridges to ensure compatibility with external blockchains (Bitcoin, Ethereum etc.) and allows you to create swap pools based on a fixed token rate. The advantage of using swap pools is to hold the price of tokens throughout the sale until the initial supply is redeemed. So, in addition to scalability, Polkastarter startups know exactly how much money they received and how many tokens they sold. Token owners — are confident that all their investments will go to the development of the project.

Polkastarter's own token is POLS. POLS holders can use them to pay transaction fees and to participate in the Polkastarter Governance Council, a democratic ecosystem governance system. All members of the Council together must hold at least 5% of the total number of POLS tokens.

Polkastarter is a fully decentralised and open source platform. This means that any developer can use the Polkastarter database to create, sell and exchange tokens for their project.

The creators of the platform emphasize that their mission is to develop and popularizethe blockchain service, thus the rest of its functions — for example, checking the launchpad users — are left to their discretion. However, assuming the possibility of such requirements from crypto startups, Polkastarter provides KYC tools that can be used upon request. Also, due to the risk of using the platform by attackers who violate the laws of a particular country (for example, in the USA and China it is forbidden to participate in IDO), or using it for money laundering and terrorist financing, Polkastarter reserves the right to check a suspicious User at any time with using KYC or AML. In spite of that, in the agreement on the use of the launchpad, the creators stipulate that the possibilities for bypassing the bans are endless and there are loopholes (apparently implying the use of VPN etc).

At the time of this writing, 109 IDO projects have been launched on Polkastarter; the total amount of funds raised is $49 million.

Red Kite

Red Kite is a launchpad based on the PolkaFoundry ecosystem.

Initially, launchpads were created to ensure the safety of investors' capital and protect startup accounts from hacker attacks. DEX-based launchpads do not always check projects, as such a procedure can be perceived as centralised intervention and an attempt to control.

Red Kite differs from many other decentralised sites in its rigorous approach to the verification of developers and investors; service specialists manually study token holders, crypto projects and their teams to protect the interests of everyone. Red Kite collaborates with Blockpass, a professional KYC service provider, to verify various data with their help, including personal data: passport, photo and application form, as well as citizenship or country of residence. The latter is the most common reason for Red Kite verification fiasco: users from the US, China, Hong Kong, and OFAC sanctioned countries (Congo, Iran, Myanmar, Sudan, Iraq, Ivory Coast, North Korea, Syria, Zimbabwe, Cuba, Belarus, Liberia) receive Pending or Unverified KYC status.

Red Kite uses its ownPKF token to attract users to the platform and give them access to verified pre-sales. To participate in the IDO, PKF holders must stake their tokens in a staking pool; the more they stake, the higher their level is and therefore the more tokens will be distributed. The minimum amount of tokens for staking is 500 PKF (Dove level), and more than 40,000 PKF (Eagle level) must be staked for a guaranteed distribution.

Another interesting feature of the site is the reputation system of participants. To prevent shareholders from manipulating the price of tokens, Red Kite monitors the actions of everyone and awards points for good behavior. If a participant is suspiciously active and speculates in tokens, his rating drops, and the opportunity to participate in the next launches is reduced.

DAO Maker

DAO Maker is a crypto incubator that uses several technologies at once, giving advantages to investors and startups. Adhering to the principle of transparency, the platform publishes data on the performance of its projects, which can be used as an indicator of their quality. Moreover, DAO Maker startups can set up tokenized incentives for community members; additionally, the owners of tokens determine rewards and incentives on their own. Reward tokens can be used in the loyalty program by spending them on products developed in the ecosystem or on the DAOMaker platform; they also provide priority access to new startup proposals.

DAO Maker is the most popular IDO platform according to cryptorank.io, it differs from other launchpads by its unprecedented high ROI (average current income) and the largest number of successfully launched projects (110+).

Summing up

- Launchpads are the important step towards the blockchainization of the world. They accelerate the adoption of cryptocurrencies in everyday life by developing, finding and supporting many new crypto projects.

- Launchpads are banned or specifically regulated in some countries. Find out the specifics of your country's legislation before participating.

Before choosing a launchpad, research its options and make sure it offers what you need, — whether it be security guarantees and KYC verification, scalability, high ROI, or passive income from crypto farming.

Join our Telegram channel to learn more cases and news from web3 space.

More articles by this author

La Migliore Offerta: The Impact of Cryptocurrency on Business and Economy in 2023

Roman Shtih

CEO Metalamp

CoW Protocol Batch Auctions: How Orderbook, Autopilot, and Solvers Ensure Fair Trading

Alexei Kutsenko

Solidity developer

CoW DAO and CoW Protocol: How Intent-Based Trading and MEV Protection Transform DeFi

Alexei Kutsenko

Solidity developer

Smart Contracts Aren’t Deployed Yet, but Addresses Already Exist: Why CREATE2 (EIP-1014) Matters

Roman Yarlykov

Solidity developer

How to Fork and Launch Uniswap V3 Smart Contracts: A Practical Guide

Alexei Kutsenko

Solidity developer

Bittensor: Overview of the Protocol for Decentralized Machine Learning

Alexei Kutsenko

Solidity developer

Aerodrome Protocol: How a MetaDEX on Base Blends Uniswap, Curve, and Convex

Roman Yarlykov

Solidity developer

Articles

Algebra Finance: Modular DEX-as-a-Service with Plugins, Dynamic Fees, and Uniswap Compatibility

Roman Yarlykov

Solidity developer

Articles

ERC-6909: Minimal Multi-Token Interface and Why It Matters for Ethereum Projects

Pavel Naydanov

Solidity developer

Uniswap v4 Explained: Hooks, Singleton Architecture, Dynamic Fees & ERC-6909

Pavel Naydanov

Solidity developer

AI Agents: How AI Agents Conquered the Crypto Market + Key Projects

MetaLamp editorial team

AI and Blockchain: Key Takeaways from 2024 and Industry Forecasts for 2025

MetaLamp editorial team

The main events in The Open Network (TON) ecosystem in 2024

MetaLamp editorial team

A Guide to EigenLayer: How the ETH Restaking Protocol Attracted $15 Billion TVL

MetaLamp editorial team

The Open Network 2025: figures, events, analytics, forecasts

MetaLamp editorial team

Overview of Blockchain Bridges: Interaction Between Different Networks

Roman Yarlykov

Solidity developer

5 Rules from the Founder: How an EdTech Project Can Attract Investments. The Case of the Online School “Logopotam”

Alexey Litvinov

CEO and founder of the online school Logopotam

Is it worth launching a project on Solana, despite the hype around memes?

MetaLamp editorial team

Mintless Jettons on TON: A New Feature Making TON Projects Even More Attractive

MetaLamp editorial team

3 reasons to choose a ready-made solution for mini-apps in Telegram instead of developing from scratch

Dmitriy Shipachev

CEO at Finch

Think of it like a hamster for traffic: how to attract an audience with a Telegram clicker game

Nico Bordunenko

Business Analyst at MetaLamp

Which Rollup to Choose for Your Project: Arbitrum, Optimism, Base, ZK EVM, and Others

MetaLamp editorial team

How We Adapted a Mobile RPG for Blockchain and Enabled NFT Sales

MetaLamp editorial team

How TON Payments Enable Fee-Free Micro-Transactions and Their Uses

MetaLamp editorial team

What You Need to Know Before Starting a Project on TON

MetaLamp editorial team

What is the Meaning and Benefits of MVP for Startups in 2024?

MetaLamp editorial team

RWA explained: Opportunities of Real-World Assets in 2024

MetaLamp editorial team

Creating a Crypto Transaction Widget for Google Sheets: The CPayToday Journey

MetaLamp editorial team

How Early-Stage Startups Can Stay on Track with Development

MetaLamp editorial team

How to Attract Investments: Insights from Successful 2023 Startups

Mykola Pryndiuk

Social Media Specialist

When and How to Find a Technical Partner for Your Startup

MetaLamp editorial team

Understanding the Necessity of Account Abstraction in the Crypto World

Pavel Naydanov

Solidity developer

Ways to Speed Up Development: Outstaffing Pros and Cons

MetaLamp editorial team

Freelancer, Agency, or Contract Employees: Who to Hire for Startup MVP Development

Yana Geydrovich

Partnership manager at MetaLamp

From Corporate Blog to Brand Media: The Birth of Metalamp Magazine

Mykola Pryndiuk

Social Media Specialist

La Migliore Offerta: The Impact of Cryptocurrency on Business and Economy in 2023

Roman Shtih

CEO Metalamp

How We Use Our Training Program to Recruit Plutus Engineers

Svetlana Dulceva

The Education Program Supervisor

Discover Why IT Companies Appreciate Our Junior Developers

Svetlana Dulceva

The Education Program Supervisor

How We Designed a No-Cost Education Program for Web Development

Sergey Cherepanov

CTO MetaLamp

Articles