Regulation

From the startup's perspective

Currently, only a few jurisdictions have clear regulations that can be applied to tokenized real-world assets, such as Switzerland, Abu Dhabi, Hong Kong, and Singapore. However, regulations vary between countries, and different types of tokenized RWAs are subject to different regulatory approaches.

In most cases, tokenized assets are treated as security tokens and are regulated similarly to traditional securities. This means that startups need to obtain relevant licenses and comply with various restrictions regarding who they can offer services to.

From the investor's perspective

The primary goal of regulation is to protect investors. However, even in countries where the project is based and regulated, there are many unforeseen circumstances not covered by the rules.

For example:

- The business center associated with your token ownership is suddenly sold, and the new owner refuses to acknowledge RWA token holders.

- The startup sold tokens to investors in the United States, and now, due to SEC demands, it has been fined $10 million, facing bankruptcy.

- The territory where you reside becomes subject to international sanctions, and the startup can no longer provide services there.

In all these cases, as an investor, you are likely to incur financial losses. Who and how will protect your rights if the startup is in Abu Dhabi and you are in Russia? This remains uncertain.

Transparency

While smart contracts are believed to ensure transparency, blockchain is unaware of events and transactions occurring off-chain. For instance, a smart contract cannot verify if a startup truly owns the underlying asset it tokenizes and in what condition that asset is. Achieving transparency requires a reliable system of oracles, external audits, and, of course, effective state-level regulation.

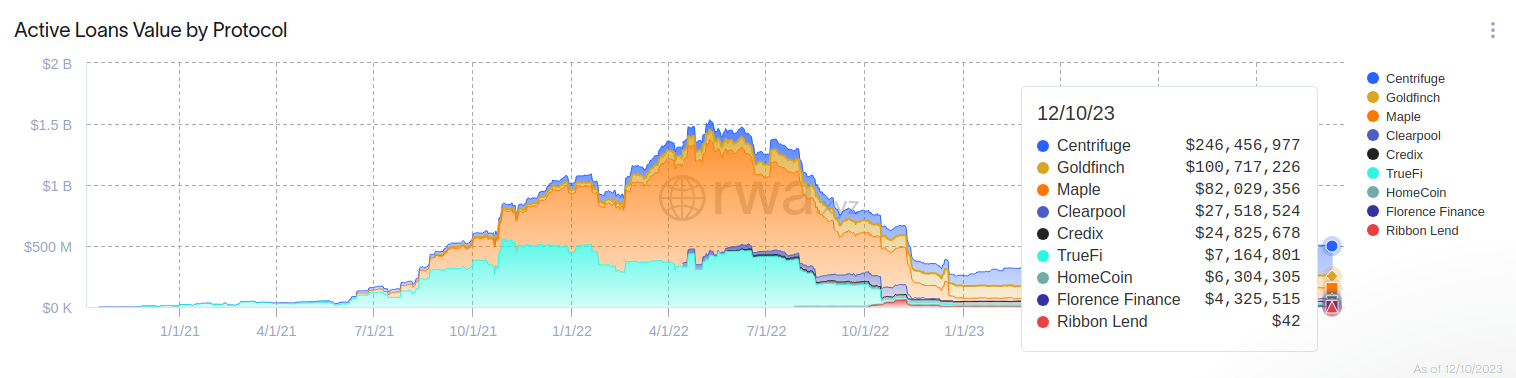

Demand

Currently, the demand for utility tokens of RWA protocols often surpasses the demand for their products. For example, as of December 10, 2023, Centrifuge's ($CFG) market capitalization was $222 million, only slightly higher than the Total Value Locked (TVL) of the protocol, which was $248 million. Clearpool ($CPOOL) had a token capitalization ($30 million) higher than its TVL ($27 million).

For comparison:

Startups in this segment thrive because venture funds readily invest in them, hoping to achieve significant profits during the peak of the bull market. The main advantage of the RWA trend, similar to the AI narrative, is its novelty. During the previous bull rally, these concepts were not discussed, making the potential for token price growth higher compared to the more established GameFi and metaverse trends.

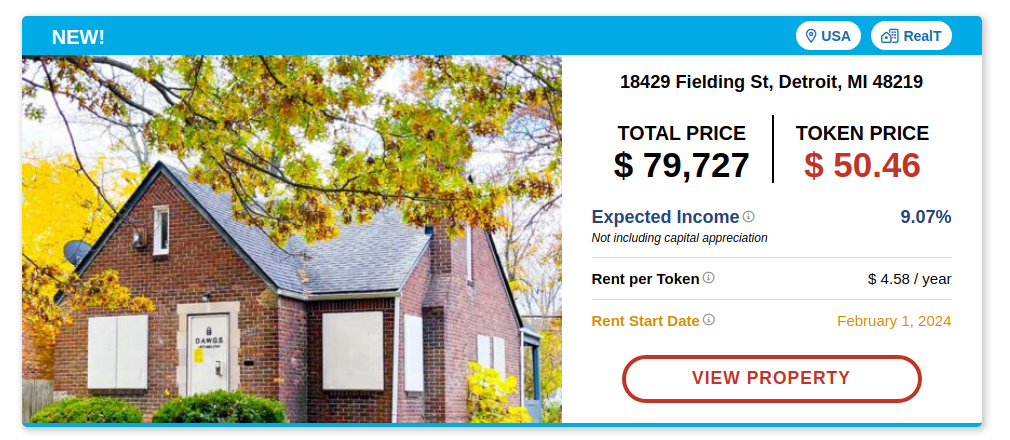

However, sustainable demand growth and effective monetization mechanisms will be required for long-term growth. Institutional investors interested in on-chain investments in bonds and other traditional assets they understand might be the key. Whether retail investors will be attracted by the prospect of a 3-9% return will be revealed over time.

Low liquidity in selling

While technically selling a real asset on the blockchain is indeed much easier than on the traditional market, there's a catch — only if there's a buyer. In the current small RWA market, finding a buyer at a favorable price can be challenging, unless we're talking about standard assets with substantial trading volumes, like Treasury bonds.

Here, we can draw a parallel with the NFT market, especially those tied to real goods like sneakers. In a market downturn, sellers might wait months for a buyer to make an offer (for instance, the phygital collection RTFKT x Nike).