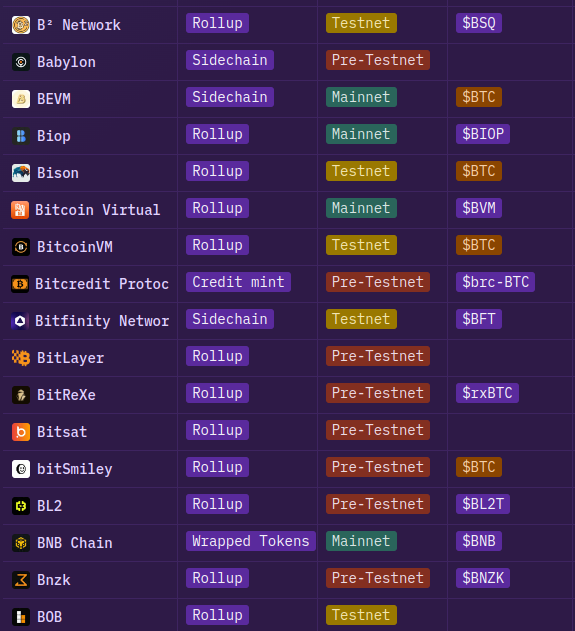

As we explained in our detailed article on rollups, L2 is any solution that helps improve the functionality of a blockchain: scaling, speeding up transactions, adding support for a new virtual machine, etc. L2 is typically discussed in the context of Ethereum, where daily transactions on rollups have long surpassed those on the main blockchain. But few people know that Bitcoin also has several L2 solutions, including rollups that are already operational and have their own ecosystems.

Let’s first look at the main problems that L2 aims to solve for Bitcoin:

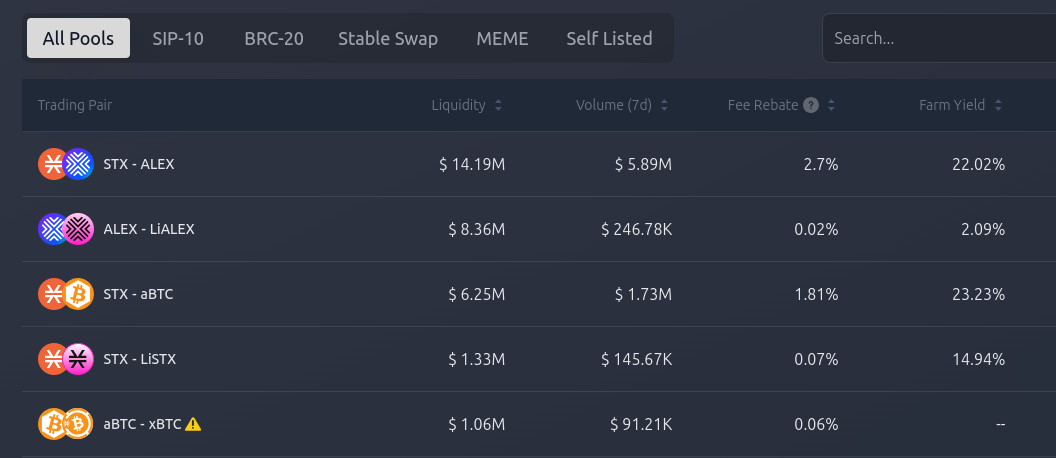

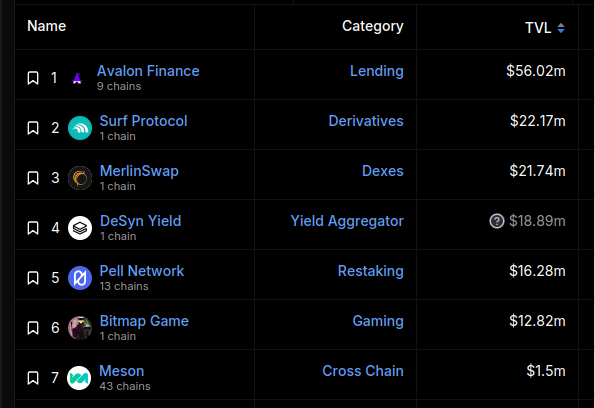

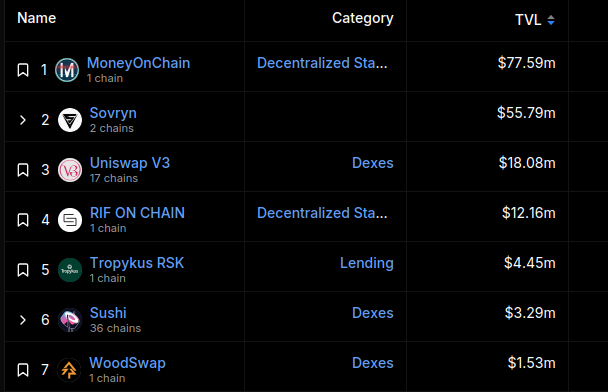

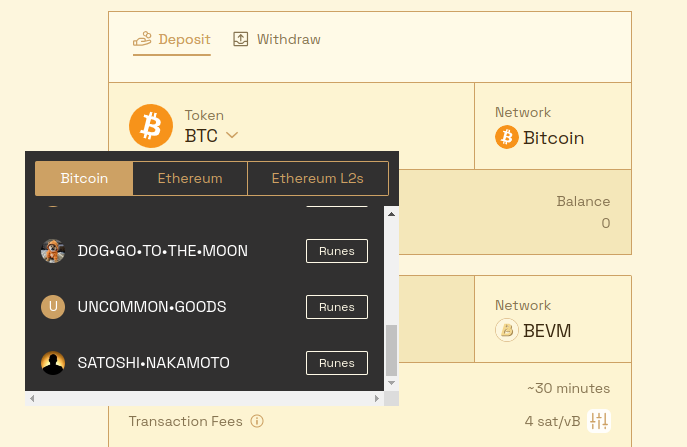

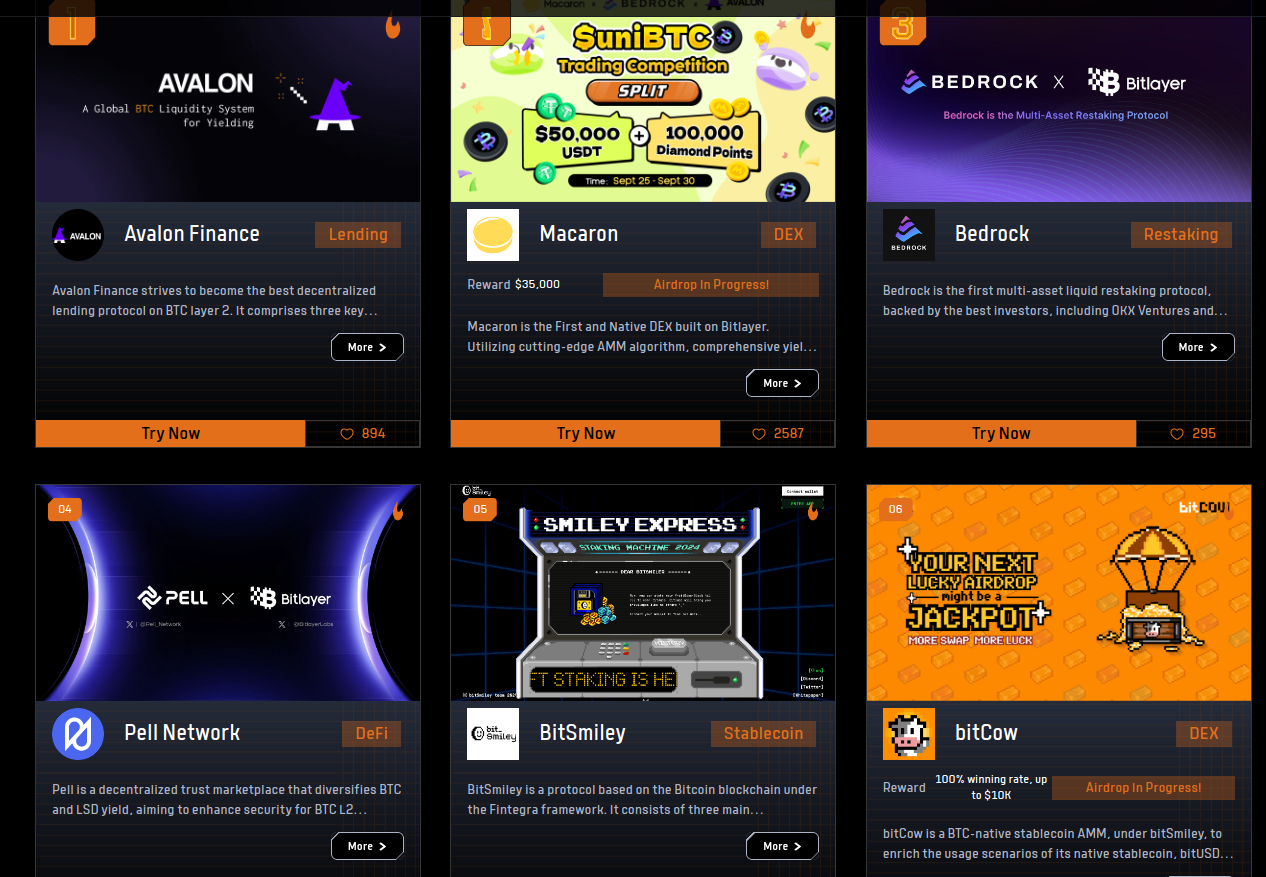

1. Support for smart contracts and decentralized applications. The Bitcoin network does not natively support smart contracts, but this limitation does not apply to its L2 networks: they can use entirely different programming languages and virtual machines (such as the EVM) and support DeFi, NFTs, and more.

This potential is perhaps the biggest draw for investors. Many believe that once Bitcoin has a fully developed dApp ecosystem, liquidity will start flowing into it from the main network, and the long-anticipated «to the moon» moment will begin.

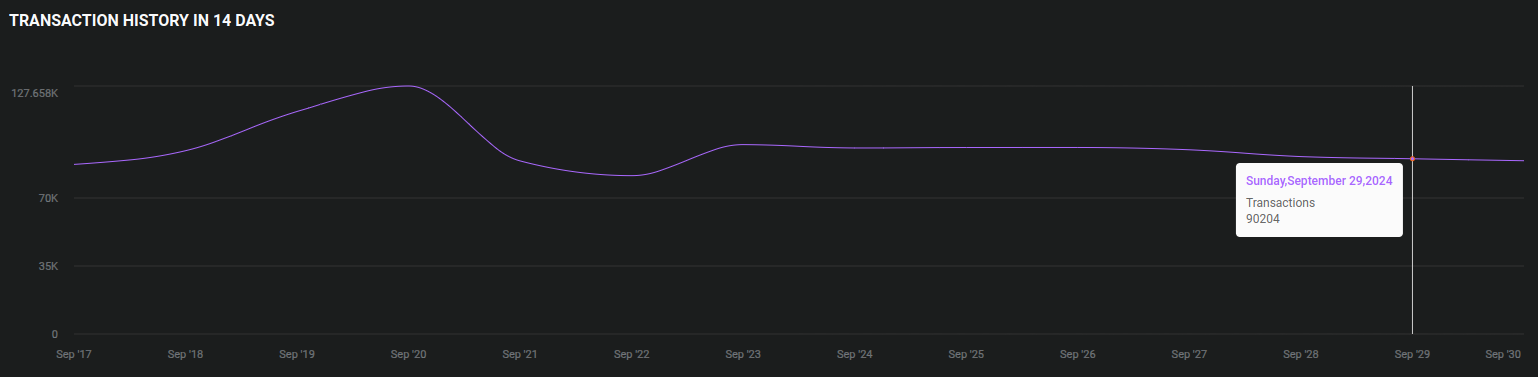

2. Scaling, which means the ability to process more transactions per unit of time and to confirm each transaction faster. Currently, each transaction takes about an hour to finalize (6 blocks).

3. Lowering fees. As of the time of writing, the average transaction fee on the Bitcoin network is around $1.20, which is lower than on Ethereum. But at the height of the Ordinals («NFTs on Bitcoin») popularity in April 2024, fees reached up to $130. By comparison, Ethereum users have access to large and reliable L2 chains like Arbitrum and Optimism, where fees are less than $0.01.

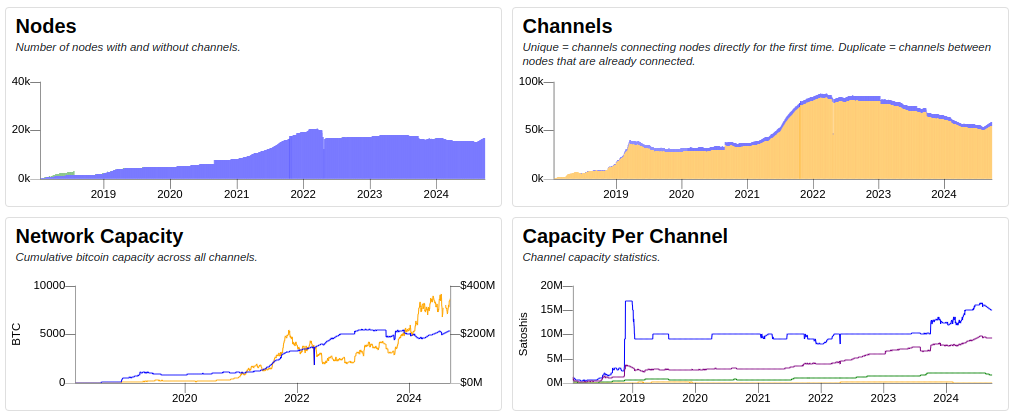

Interesting fact: L2 for Bitcoin appeared before L2 for Ethereum. The Lightning Network — a «fast payment system» on BTC — was introduced in 2015 and launched on the mainnet in 2018, while a similar solution for ETH, Plasma, only emerged in 2017. By the way, Plasma eventually evolved into Optimism, whereas the Lightning Network still operates, though few people use it.

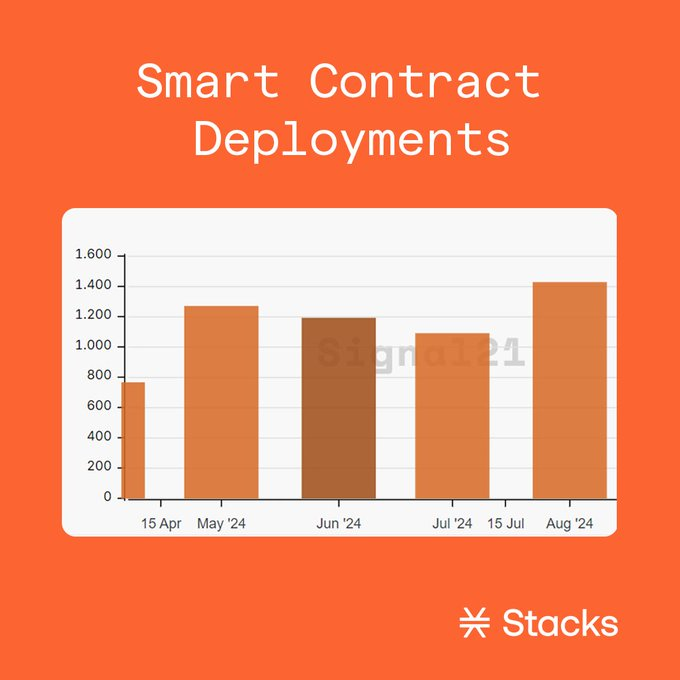

This article, however, will not focus on the Lightning Network but on L2 solutions with their own ecosystems, where new projects can be created. Some of these have been on the market for a long time (for example, Stacks), while others have emerged in the past year or two, riding the wave of popularity around Ethereum L2.