Trading rare and collectible beverages using blockchain technology opens up new opportunities for both producers and investors.

Benefits of tokenization for sellers

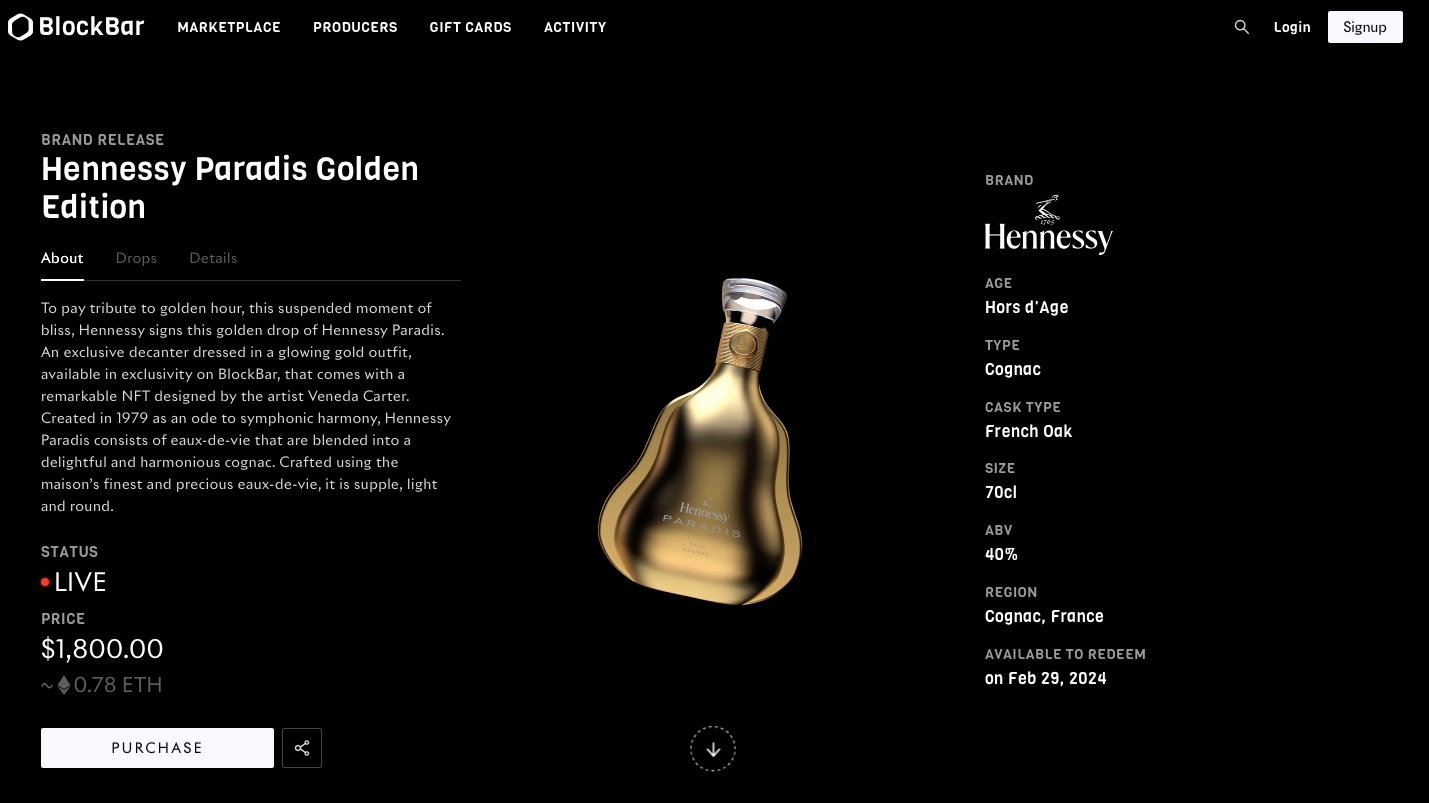

Manufacturers can enter the crypto market, automate transactions for selling premium alcohol, and gain an additional marketing tool.

A new distribution market. By issuing NFTs for a bottle of expensive wine, a company enters the crypto market and attracts funds from digital investors. These investments can be directed into real business ventures.

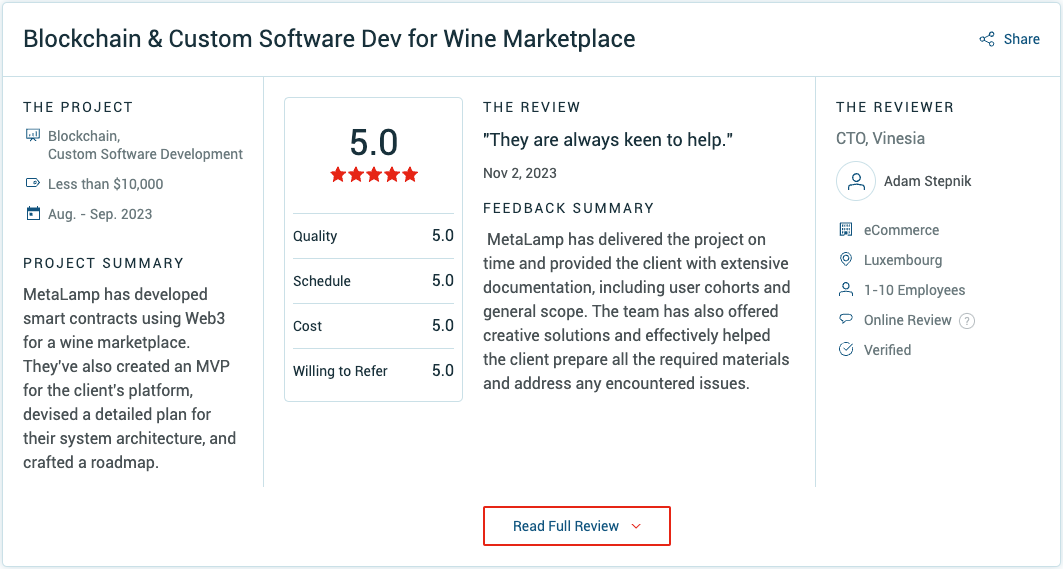

Automation of transactions through smart contracts. A smart contract is a digital agreement between a seller and a buyer that operates on the blockchain. The smart contract establishes rules for the company to sell premium alcohol for tokens, ensures both parties' commitment fulfillment, and automatically executes contract terms upon specific actions. For example, when an investor purchases a bottle of whiskey as an NFT, the investment platform receives 10% of the purchase price.

Marketing and PR tool. Many premium alcohol producers issue NFTs to attract new audiences and strengthen their positions in the offline market.

Benefits of tokenization for buyers

The key benefits for an investor who decides to purchase tokenized premium alcohol are security, liquidity, traceability, and control over storage conditions.

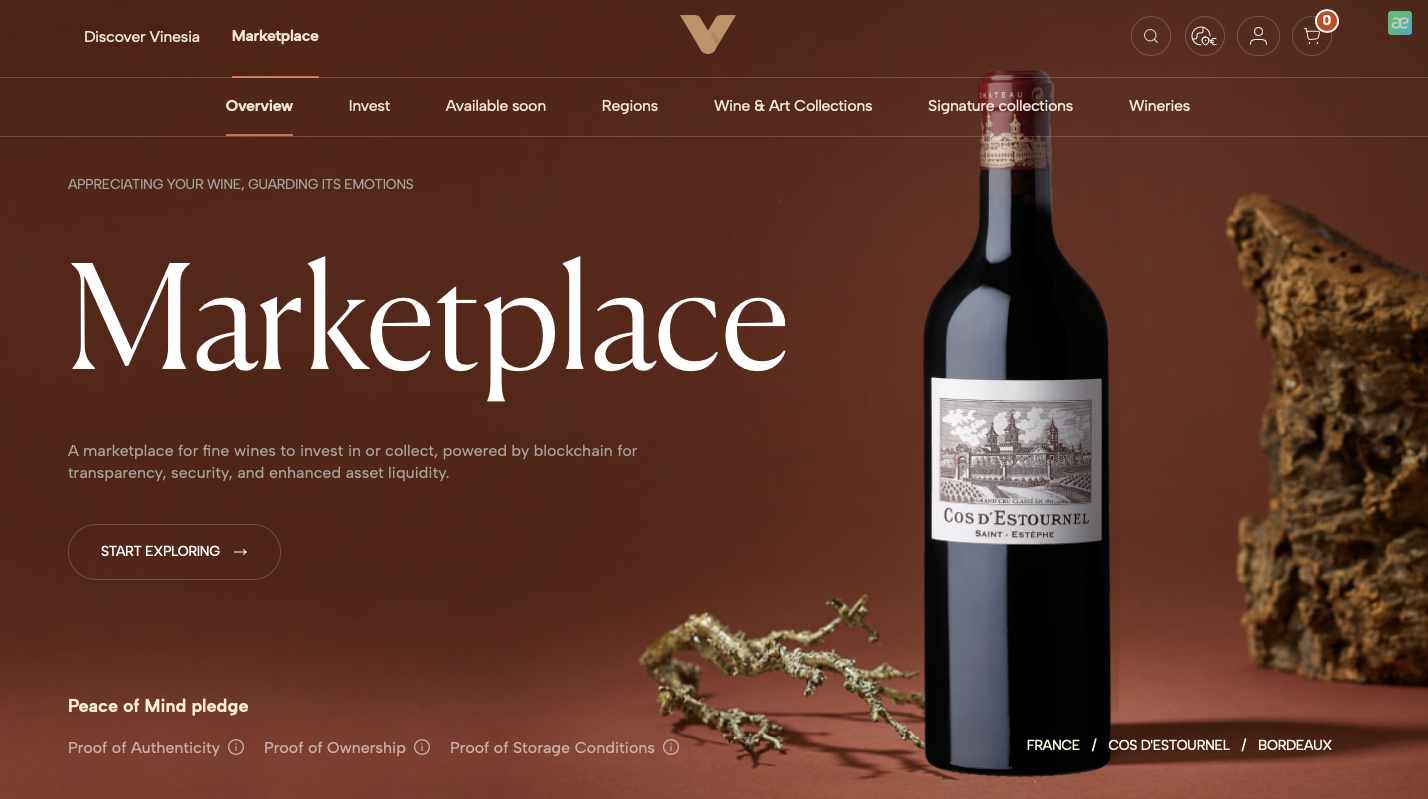

Security. Investment platforms offering premium alcohol source lots directly from manufacturers and verified collectors. Investors can be completely confident they are investing in authentic wine or whiskey, not counterfeit products.

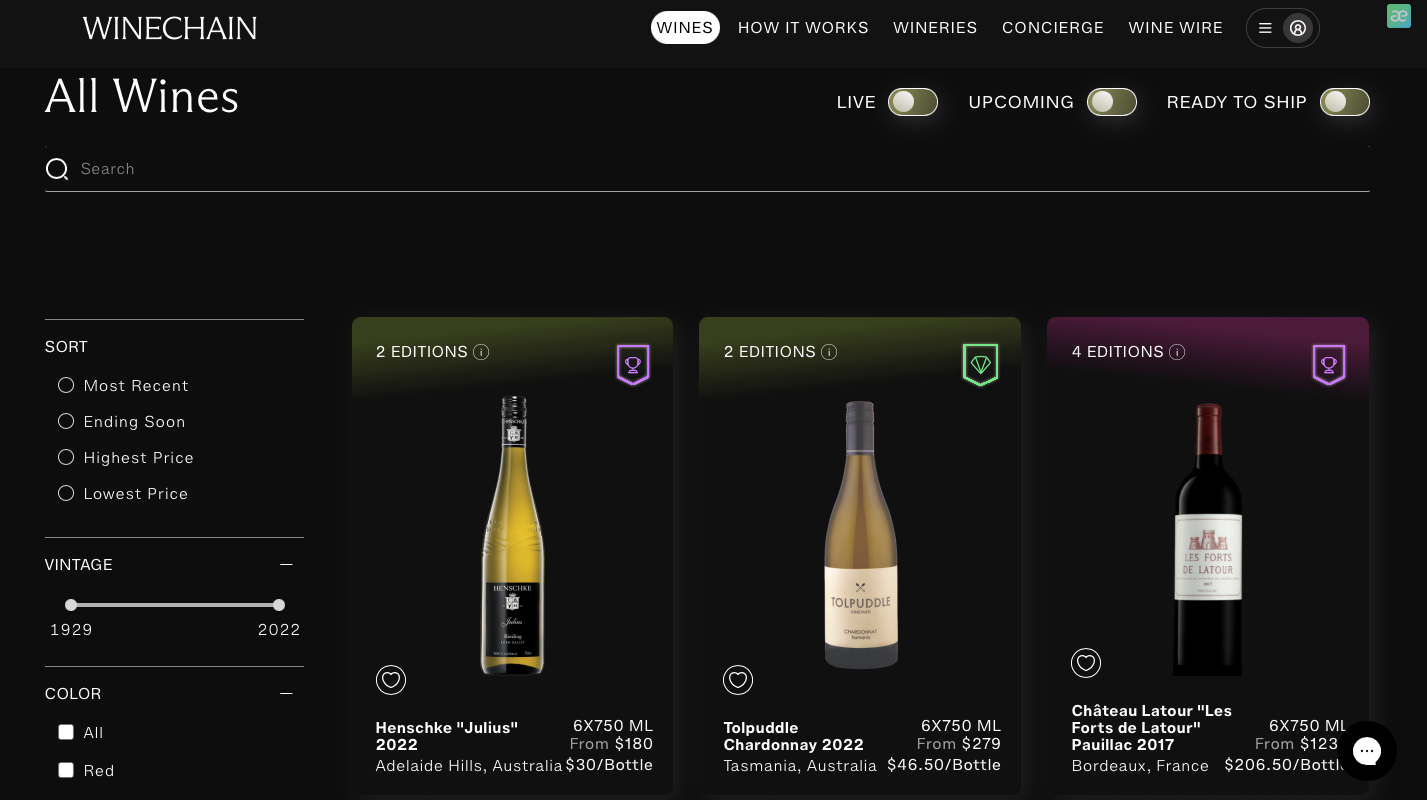

Liquidity. Collectible wine is a highly liquid asset that can be challenging to sell on the secondary market due to high shipping costs and time-consuming logistics. Intermediary platforms eliminate these barriers by handling all logistics, making transactions as straightforward as trading stocks.

Traceability. When purchasing an NFT, it can be difficult to prove ownership of the physical item, especially if the wine bottle is located elsewhere, often on the other side of the world. For instance, each wine bottle sold on the Vinesia platform is marked with NFC and BLE tags. NFC tags transform the bottle into a trackable digital asset, ensuring the investor is the sole owner of that wine. BLE tags display the bottle's location on the website, reassuring the buyer that their wine is indeed in storage.

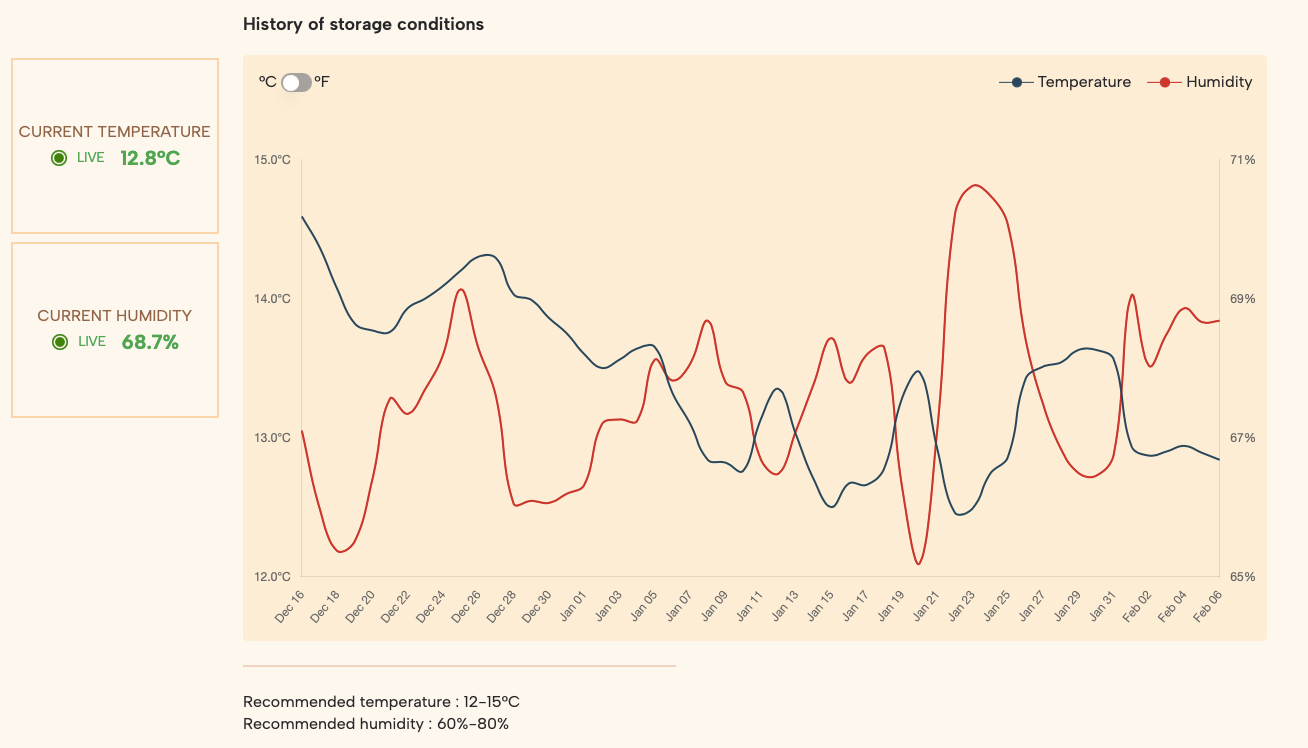

Control over storage conditions. It's challenging for collectors to monitor the temperature and humidity of wine cellars and ensure their beverages are safe. Therefore, platforms selling tokenized drinks allow buyers to monitor storage conditions in real-time. Typically, on the product page, you can see the current temperature and humidity in the wine cellar and how these metrics have changed over the storage period.