The blockchain is not ready for organizational and social change. The thing is that it has several technological disadvantages, which do not contribute to the rapid growth. First, the lack of use cases slows down the blockchain implementation. The examples of its successful adoption in business, in practice or the expertise of organizations in working conditions would affect blockchain demand positively. However, it is hard to find cases so far. So, it affects the blockchain badly.

Another issue is related to the fact that important actors do not seek to share their experiences. Blockchain does not have sufficient community support and well-established processes yet.

“There is a significant difference between centralized and decentralized information processing. While developing a familiar product from banking or Fintech on the blockchain, you need to almost re-invent ways to implement classic functions,” - shares observations Kirill Elizarov, a developer at MetaLamp.

Also, there are organizational and ethical issues. Another problem is the data reliability while executing smart contracts. We cannot always control the data correctness and integrity, as we rely on the blockchain database, where everyone can write and read something”, - Kirill explains.

Speed processing, which results in the lack of technical scalability

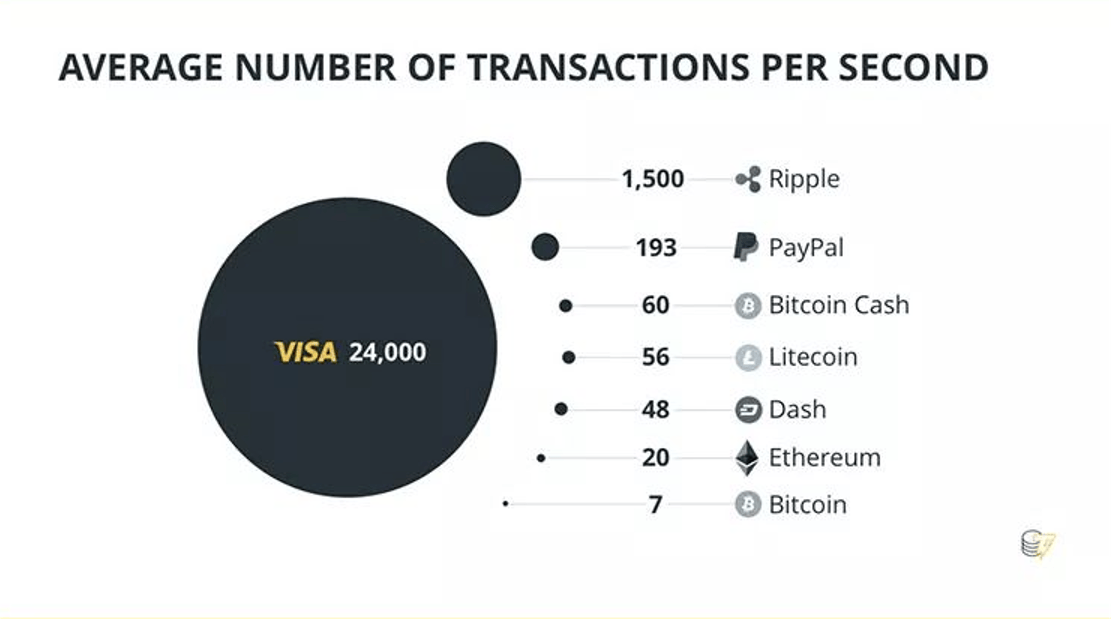

If we look at the familiar transaction networks, there are no speed problems. For example, De Meyer claims that Visa can process more than 2,000 transactions per second. The most famous blockchain technologies are much slower: Bitcoin processes up to 7 transactions per second, while Ethereum is up to 20 transactions per second.

When the number of network users increases, the transaction processing takes longer. If these are transfers within the same banking system, the blockchain loses the transaction speed, quality and costs a lot.

It is not a big problem for businesses with private blockchain networks. Although, if you build extensive networks, the operation will be slower.

Despite scepticism, the market has already announced and implemented engineering solutions to speed up and reduce the transaction cost. For example, De Meyer tells about the Lightning Network that adds a second layer to the network for acceleration.

There is also another solution. You can use Proof of History (PoH) algorithms and Gulfstream and Turbine data transfer protocols. For example, it is how the Solana blockchain operates. Unlike Ethereum, Solana does not have sidechains or parachains. According to the representatives of the Solana Foundation, the current blockchain capacity is 60 thousand transactions per second. It can be up to 710 thousand transactions per second soon. As for technology optimization, it is remarkable that the transaction cost has been reduced to $0.00025 comparing to $5 for Bitcoin.

The 4th generation of blockchains offers high scaling potential, easy implementation, low cost and fast transaction speed. Along with Solana, such platforms as Insolar, MetaMUI and Aergo have these advantages.

Lack of standardization and limited compatibility

Today we can develop blockchain projects in different languages. They have differences in the consensus mechanisms and the ledger model. So, such a variety of blockchains has not defined the standards and general principles for different network interactions. For instance, transferring assets from one blockchain to another is a non-trivial engineering task. So, it affects the scalability and attractiveness of blockchain by both organizations and individuals.

Establishing industry standards for blockchain network protocols could help businesses implement it steadily. They would not worry about difficulties in integrating and collaborating with the blockchains of partner companies.

Nowadays, there are no unified blockchain development standards. However, the first initiative has been already taken. They have established international committees from 42 countries to find a solution.

To regulate processes, many large companies join forces to improve the security and quality of blockchain applications. For example, eight companies, including Cisco Systems Inc (CSCO.O), Bosch Ltd (BOSH.NS) and others, decided to develop a unified protocol for the Internet of things. Another consortium includes about 40 banks headed by the Central Bank of Singapore. They aim to introduce blockchain technologies in the Asia-Pacific region with R3 fintech company.

“The problem is that blockchains use different standards. Some of them do not imply standardization at all. Although there are developing regulations for blockchains interaction, for example, https://ibc.protocol.org”, - says Stanislav Zhdanovich, a developer at MetaLamp.

At the same time, there is a tendency for the “communicability” of various blockchain systems.

“These projects can be used as a sidechain for bridging tokens from one blockchain to another. For example, here is milkomeda.com”, - adds Kirill Elizarov, a blockchain developer at MetaLamp.

If we talk about integration with traditional systems, we also face obstacles here. To implement blockchain into a legacy structure needs a complete reconstruction. If you do not understand the social significance of such changes, the process regulation and political will, then it is hard to expect rapid technology adaptation.

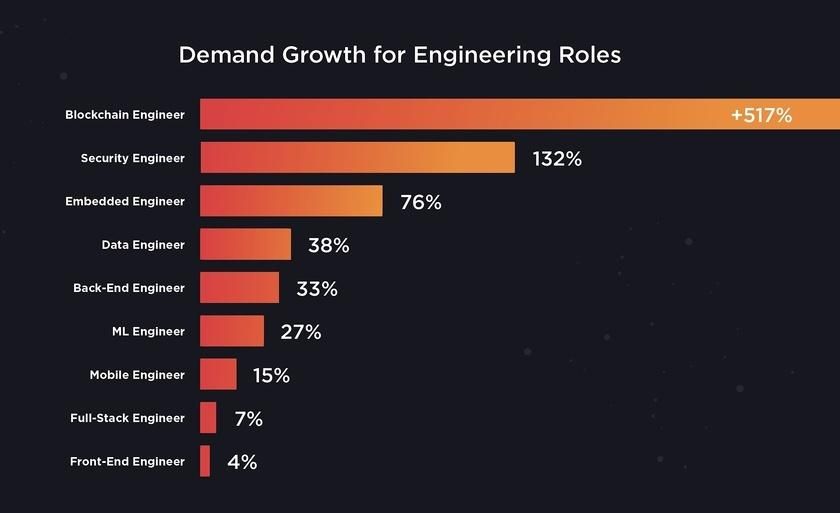

Lack of qualified developers

Today, any technology is probably in need of qualified employees. But, for example, if the frontend development already has clear requirements and educational programs due to the large distribution, the case with blockchain is more complex.

The demand for developers is growing exponentially. However, companies do not need juniors but qualified specialists to manage complex networks. According to De Meyer, the demand for blockchain-related specialities has increased by almost 2000% from 2017 to 2020. The industry can not keep up with such technological development.

The developer community needs time to master the technology. Educational institutions also need to introduce appropriate blockchain-related courses. The university in Cyprus has become a pioneer in academic education on "Blockchain and Digital Currencies". Today there are similar programs and individual subjects in many leading universities worldwide.

“As for the personal experience, it took about three months to master the basics of blockchain development from scratch. One of the challenges is that we do not have enough experience with new technologies. The tools are constantly changing, and it complicates its mastering, use and standardization in project implementation”, – says Kirill, a blockchain developer at MetaLamp.

People do not understand how blockchain works

Traditional financial technology tools are hard to understand. For example, clients are unlikely to tell how Visa works and how it differs from other systems in terms of technology. The blockchain is even more difficult. Technical specialists dominate here due to the high entry. So, the blockchain has few popularizers who can tell about this approach and its benefits in a simple way.

It makes it hard to look for new ideas and involve specialists from other areas. You can influence the situation if you focus not only on the technology development but on improving the user experience.

In short, modern financial systems are challenging to master, but they still can be used easily. So, designing tools which people can use successfully even without understanding the operation principle is one of the ways of blockchain development.

Security and privacy issues

There is an opinion that you can not hack blockchain systems. It is a myth. Blockchain is more secure than many advanced programs, but it does not prevent hackers from breaking into applications and systems built on the blockchain.

For example, hackers organized 169 hacks of blockchain systems while stealing almost $7 billion in 2021 alone. Moreover, so-called white hackers took and returned another $704 million.

It is a complex psychological problem. On the one hand, people tell us that the blockchain is secure. On the other hand, we see news about hacking exchanges and stealing personal data.

In general, the issue of security and privacy is complex and multifaceted. The blockchain contradicts the European regulation on the personal data protection (GDPR - General Data Protection Regulation), as the information in blocks can not be changed or deleted. It deprives users of the so-called “right to be forgotten”.

To trust blockchain projects, users must have privacy. But the question is what scale it should be and who controls it? Adele de Meyer, a co-founder of DAPS Coin, describes it as follows: “I think it is a 'stumbling block' now. If you think about it differently, they (governments) also have access to information, unfortunately through centralized exchanges, as you have to pass KYC. Compliance with KYC/AML procedures deprives system participants of their privacy rights. For example, it allows you to discriminate according to some criteria.

We feel like being deceived, and it does not motivate us to invest in the industry.

“This feeling is mainly provoked by the “pseudo-anonymity” of blockchain. Any blockchain has the property of public verifiability. It means that anyone can enter the network and see information about any transactions since the platform launch.

Stanislav Zhdanovich, the MetaLamp blockchain developer, says: “The transaction addresses are encrypted with a random set of letters and numbers. However, the address can be associated with a specific person, for example, for transactions in the same store. Nevertheless, we can solve this problem easily through zero-knowledge proof. For instance, this blockchain has completely private transactions https://z.cash/.”

As for the technical aspect of the security issue, a lot depends on the executor's qualification.

There are many threats to the distributed networks functioning, including Attack 51% and Sybil attack, phishing, DDoS and blockchain endpoint vulnerability. Nevertheless, if you have the right approach to developing and maintaining digital platforms, you can avoid attacks and ensure the system works reliably.

Stanislav Zhdanovich, a developer of MetaLamp, explains it this way: “They hack not the blockchain itself, but smart contracts. The encryption and consensus protocols have proved their security. But smart contracts are programs which operate on the blockchain. There are often bugs which depend on human factors. To make a blockchain project secure, you need to audit smart contracts and test them at all system levels. You should also launch a trial period which will warn users that the system is in experimental mode."

Lack of government regulation

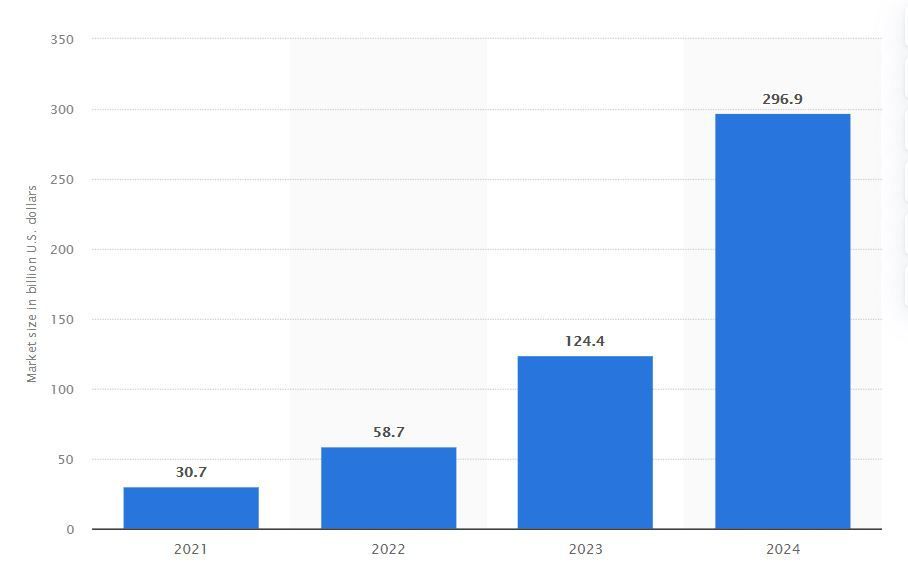

According to Dmitry Noskov, an expert at the StormGain crypto exchange (a platform for trading, exchanging and storing cryptocurrency), people will recognize the blockchain later. Then we will have a well-developed regulatory framework, and the market will become regulated. So far, the governments do not have a consensus regarding the blockchain.

If we look at the cryptocurrency, the Swiss have already recognized it as a payment method. They can pay with bitcoins for purchases, taxes and utility bills. At the same time, the Chinese authorities outlawed mining and imposed restrictions on digital coins. Every second American owns a cryptocurrency, but the government have not defined its legal status yet.

However, many banking sector actors already work with Ripple Labs (it uses a centralized blockchain). For example, there are American Express, Bank of America and about 100 financial institutions.

On the other hand, the Central Bank and the Ministry of Finance in Russia have no consensus regarding cryptocurrency. Nowadays, you can invest in it, but it can not be a payment method.

“The crypto industry capitalization is rapidly growing. The first countries which realize its benefit and potential will change for the better their economic and political status in the international arena within a short period”, - says Stanislav Akulinkin, CFO of EMCD, the largest mining pool in Eastern Europe, MBA, PhD.

According to blockchain developer Jack Snell (Metafurkitty Company), the blockchain future depends on the willingness and ability of business and government leaders to educate themselves and master new technologies. “The Congress has embarrassed itself by not conducting any research and inability to explain what blockchain is. However, they still insist that it is a bad thing. Here I refer to the trial on crypto with crypto industry executives a few months ago. JP Morgan, CEO, criticizes crypto but invests billions in the metaverse.

Authorities are afraid of losing their power/influence, so they spin a false narrative. Others support this negative reputation because they do not know what they do not know. Today we are experiencing a massive paradigm shift. We will see those who adapt and thrive and those who refuse to change. Countries that do not adapt will be left behind”, - believes the expert.

We already have examples of when the blockchain implementation has led to positive results in the operation of the companies. For example, the R-Chain platform works based on distributed registries. So, Raiffeisenbank reduced the document preparation and the payment term processing from several days to a few seconds. Gazpromneft-Aero can pay for aircraft refuelling online.

China has banned the purchase of cryptocurrencies on markets. The country is preparing to launch its competitor, the digital yuan. Despite the scepticism regarding crypto, countries are interested in blockchain technology. The Danish Foreign Ministry came up with the idea of corruption elimination through blockchain and restoring national trust in authorities.

Brazilians will register property ownership through a blockchain platform. The test run was successful. Next year, they plan to allow the payment of property taxes in crypto. The governments on the African continent decided to support blockchain and cryptocurrencies.