Is it worth launching a project on Solana, despite the hype around memes?

Solana is much more than just a «meme blockchain.» It’s the leading ecosystem in terms of active addresses and DEX trading volumes, with numerous technological projects, grant programs, and the potential for massive growth after the release of the Firedancer client. Here’s why it’s worth launching a project on Solana – and how to leverage the best practices from the meme industry.

Solana’s Impressive Comeback

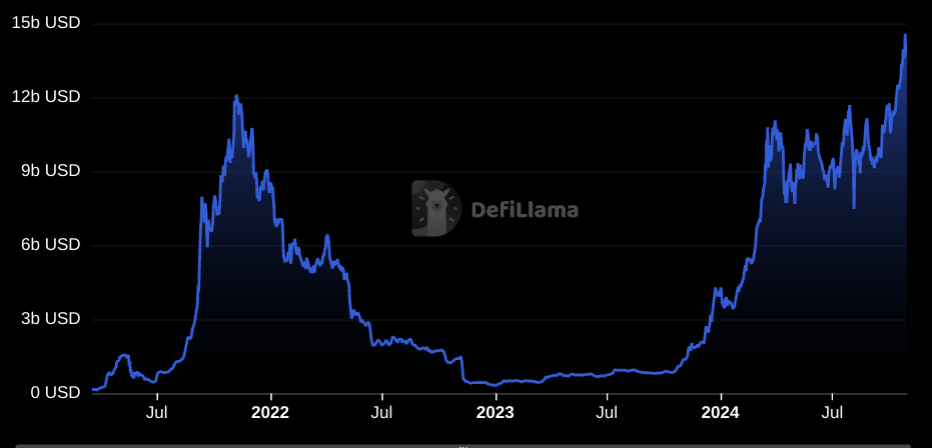

$12 billion in TVL at its peak in November 2021, followed by a 98% drop to $210 million in January 2023, and a long period of stagnation until October 2023. The price of SOL plummeted from $250 to $10, and even Solana’s blockchain smartphone, the Saga, was declared the worst smartphone of 2023.

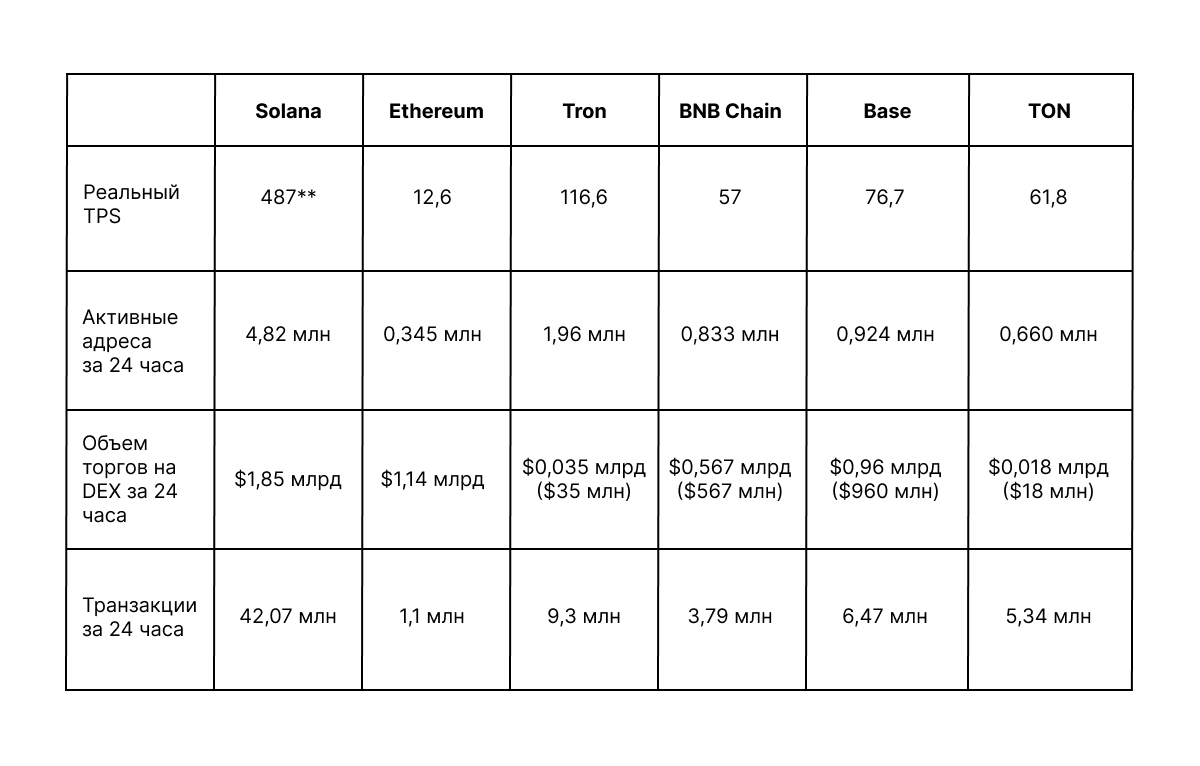

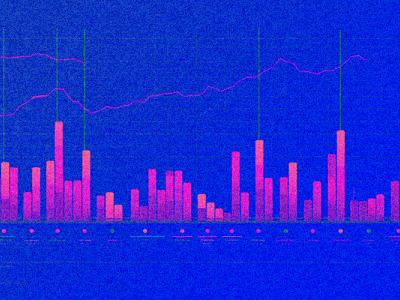

Many had written off Solana, but since October 2023, its metrics have started to rise again. By October 2024, TVL had reached $13.9 billion, and although Solana ranks second in TVL after Ethereum*, it leads by a large margin in several key on-chain metrics, as shown in the table (all data as of the end of October).

Solana leads in all major on-chain metrics. Data sources: The Block, Etherscan, OKLink, BSCScan, BaseScan, Into The Block, Tonscan.

*By default, DeFiLlama displays TVL without including liquid staking, which places Solana in third position after Tron with $6.1 billion. However, liquid staking is a crucial component of DeFi, and without it, the picture is incomplete in our view.

**Only user transactions (non-vote). Including validator vote transactions, total TPS is around 3200.

A bit more statistics: although the price of SOL is currently 30% lower than its peak in 2021, DEX trading volume is now 6 times higher, and the number of active addresses is 8 times higher.

To be fair, a significant percentage of active addresses on Solana are bots trading on DEXs, as well as addresses created en masse for airdrop farming and other activities where having multiple accounts can be profitable. Bots are also responsible for the high trading volume. However, the very fact that Solana’s ecosystem has become a prime target for bots demonstrates its popularity.

The main factor that allowed Solana to regain its leading position in 2024 is undoubtedly memecoins, which in 2024 became as much of a catalyst for on-chain activity as NFTs were in 2022.

Because of this, projects in other niches (DeFi, GameFi, RWA, etc.) are often hesitant to launch on Solana, seeing it as a «non-serious» blockchain. However, as we’ll demonstrate in this article, there are several good reasons to consider Solana for your project—and, by the way, there are some valuable lessons to learn from memecoins.

How Solana Became the #1 Chain for Memes – and What We Can Learn from It

At the end of October, the price of SOL shot up by 19% in a single week, while ETH dropped by 3% and BTC remained mostly unchanged. One of the reasons for this rise is the new narrative around AI memes: memecoins that are created and/or promoted using AI.

But this is just the latest twist in the rapid evolution of memecoins on Solana. To understand why, let’s start with the fundamental characteristics of this blockchain that make it an ideal environment for memes:

- Low cost of launching a new token – using the Pump.fun platform, you can even do it for free (not counting marketing costs).

- Low trading costs. Memecoins are speculative assets characterized by high-frequency buying and selling with small transaction sizes, so low fees are critical.

- Fast transaction processing: transactions are finalized in 5 seconds, which is important given the extreme volatility of memecoins.

No threat from malicious DEX bots (like sandwich bots) that profit at the expense of other participants. On Solana, participants in the memecoin market operate on much more equal terms than on Ethereum. - Constant innovation: thanks to its low fees, Solana serves as an incubator for new narratives and technological experiments, such as the Pump.fun platform for creating memecoins and Telegram bots for DEX trading.

Pump.fun and the Trojan Bot – a Perfect Market Fit

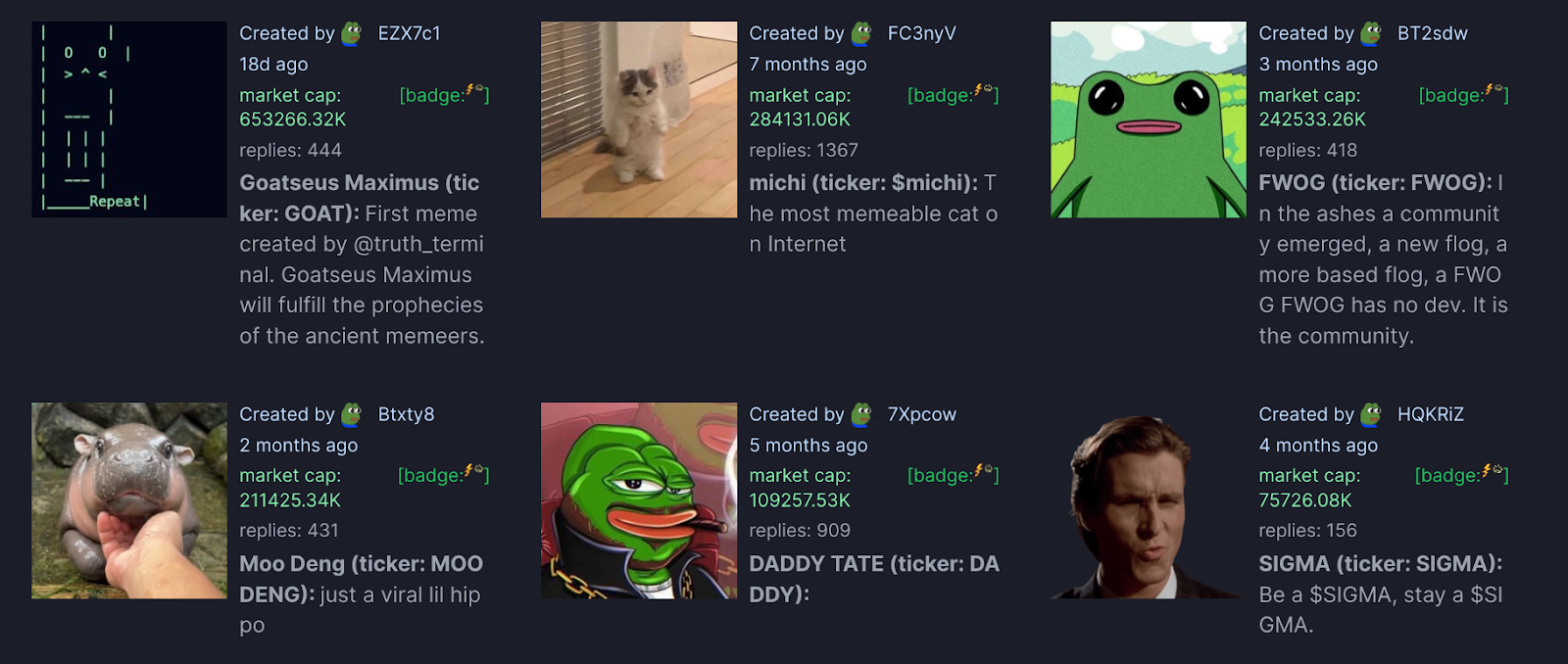

Pump.fun is a website where you can launch a new meme token almost for free and without any programming skills, and it will immediately start trading on its own DEX, Pump.fun. You don’t even need to invest in initial liquidity.

It’s so simple, even a child could do it: connect your Solana wallet, choose a name and ticker, add an image, click «Create Coin» – and that’s it, your memecoin is created.

Each purchase slightly increases the token’s price; once the token’s market cap reaches $69,000, a liquidity pool with $12,000 is automatically created on the Raydium exchange. Obviously, only a tiny percentage of memes on Pump reach this stage.

For buyers, the advantage of Pump.fun is that all memecoins start with a «fair launch,» meaning no private rounds or team allocations. Plus, there’s no risk of creators suddenly pulling all liquidity from the pool and disappearing.

Among the popular memes launched on Pump.fun are $MOTHER, $MOODENG, $GOAT, and others. Most trading is done via Telegram bots, primarily Trojan.

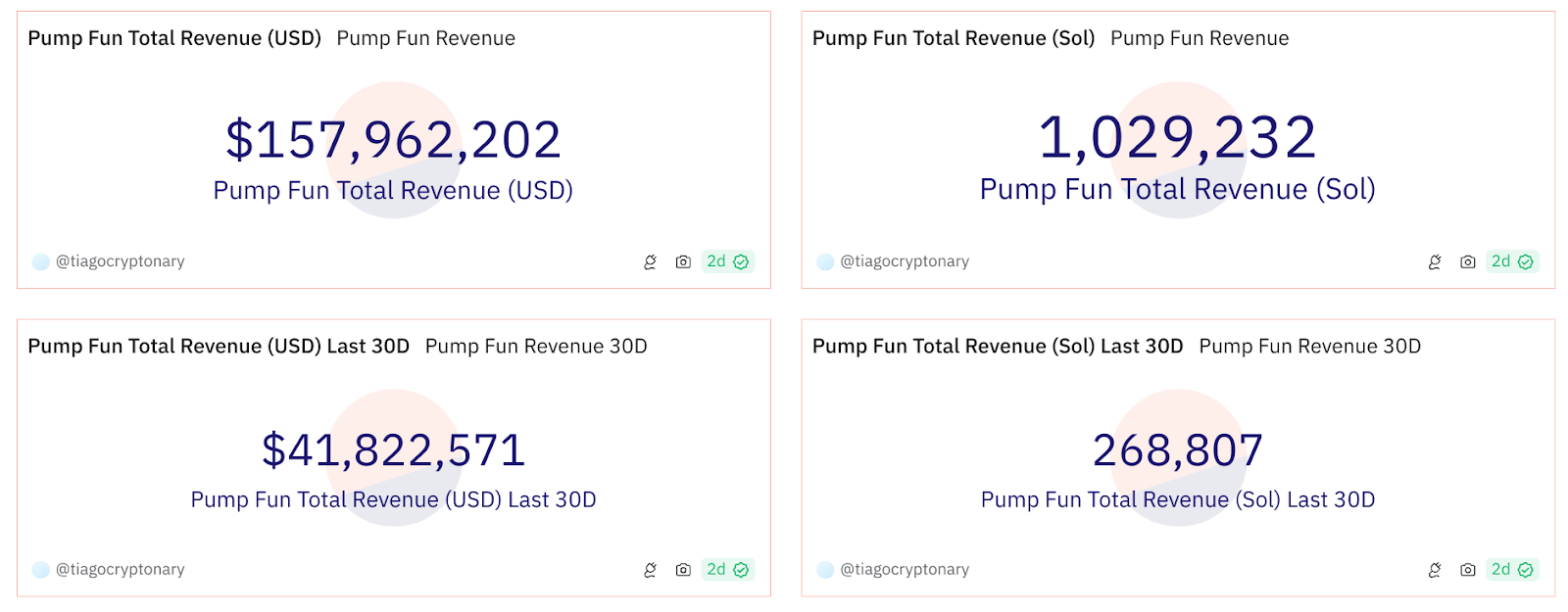

Pump.fun is a great example of product-market fit with a clear monetization strategy: a 1% trading fee (token creation is free). The result: $158 million in revenue since the platform launched, with $41.8 million in the last month alone. And all this without venture capital support, expensive marketing campaigns, or a polished interface — just a product that met market demand and that people were willing to pay for.

Source: @tiagocryptonary on Dune Analytics

The same can be said about trading bots on Telegram, especially Banana Gun and Trojan. These bots allow users to instantly buy newly launched memes («sniping» with sniper-like precision), set limit orders, and even copy trades from successful traders. Without such a bot, it’s nearly impossible to trade memes profitably, especially at the launch stage — manual swaps simply can’t be done fast enough in high-volatility conditions. So it’s no surprise that Trojan earns around $500,000 per day in fees.

What Serious Projects Can Learn from Memecoins

Among «serious» projects, memecoins are often viewed with disdain or even hostility — they supposedly cannibalize liquidity, divert attention from quality tokens, drive up fees, and so on. However, these same serious startups could learn a few valuable lessons from the meme industry:

1. A loyal, organic community can «lift» a token without expensive marketing. On the other hand, a community artificially created through paid traffic won’t have the same effect.

2. If a product is truly useful, people will pay for it, even if the interface is rough around the edges (see: Pump.fun). It’s better to launch and start monetizing immediately than to delay for months polishing the design. We covered how to quickly package an MVP for testing in our article, «How to Create a Startup MVP Design in 7 Days»

3. Monetize from day one: even if you plan to raise venture capital, imagine you won’t get it and that you’ll need to fund the project’s growth solely through product monetization. Can the app generate thousands of dollars per day from the start through fees, game NFT sales, etc.? If not, it may be worth rethinking the concept.

4. Addressing a timely problem is often more important than solving a fundamental market issue. Manual meme trading is difficult, and the Trojan bot, by solving this problem, brings in millions of dollars for its creators.

5. A token will be in demand if the product itself is in demand. A good example is $BANANA, the token of the Banana Gun bot, which allows holders to earn a share of the bot’s revenue. $BANANA is traded on Binance, OKX, and other major exchanges, and its price chart is the envy of many tech tokens with flashy whitepapers.

$BANANA chart: when a token’s price reflects the product’s relevance

Not just memes: DeFi on Solana

Among the top 10 largest DeFi protocols on Solana:

- Three liquid staking projects – tools that allow users to delegate SOL to validators and earn staking rewards, while receiving special liquid tokens that can be used in DeFi. Jito and Marinade are classic liquid staking protocols, while Sanctum positions itself as a «liquidity layer,» essentially a DEX for trading various liquid tokens.

- Two DEXs – Jupiter and Raydium.

- One lending protocol – Kamino.

- One on-chain futures trading protocol – Drift. Offers contracts on SOL, BTC, ETH, TIA, DOGE, and others, with leverage up to 50x.

- One oracle – Pyth Network.

One hybrid protocol – Marginfi, which provides solutions for lending, liquid staking, and passive income. - One DAO creation platform – SPL Governance.

It’s worth noting that, compared to platforms like Tron and Base, Solana’s top applications are missing protocols in the RWA (real-world assets) sector, stablecoins, and SocialFi. Additionally, there’s a lack of quality GameFi projects: none of the top 10 games by user count are on Solana. Teams considering launching a startup on Solana should take note of these sectors as potential opportunities.

Technical issues on Solana – and what will change with the release of the Firedancer client

Solana is often criticized for supposedly being unreliable, frequently experiencing outages, freezes, and transaction failures. Let’s take a closer look at each of these issues.

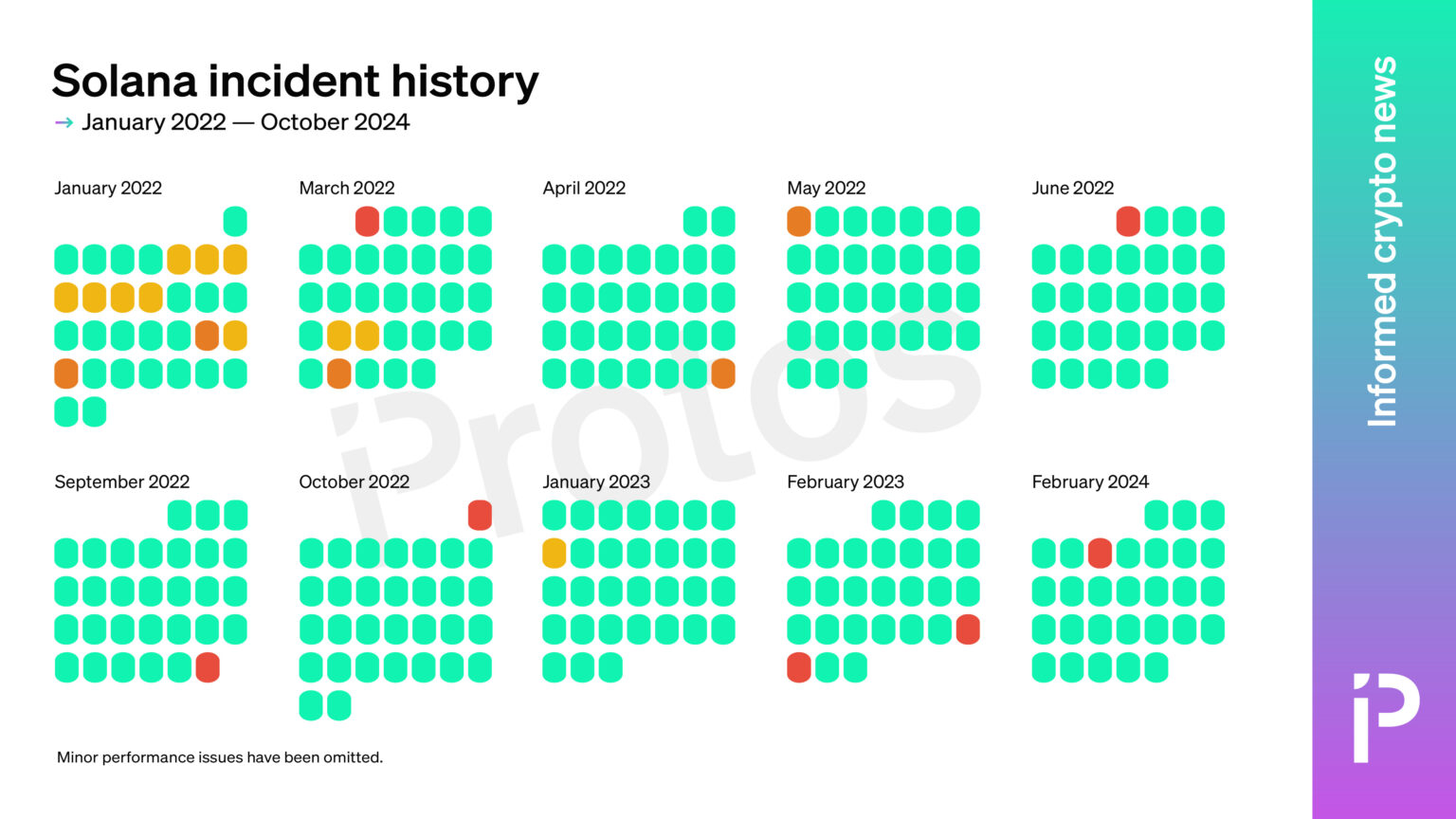

- Blockchain Outages

In reality, the last such incident was in February 2024, when Solana was down for 5 hours, and before that in February 2023. This means Solana has been running without interruptions for 8 months, so claims that it «constantly freezes» are highly exaggerated.

Moreover, Solana isn’t the only blockchain affected by outages during peak loads. For example, in August 2024, TON went down for six hours due to a surge in transactions related to the $DOGS airdrop. This incident prompted TON to implement mintless tokens, a technology allowing large-scale airdrops without impacting network performance. We covered this in our article, «Mintless Jettons on TON: A New Feature Making TON Projects Even More Attractive».

Source: Protos

2. Wallet Outages

On October 28, Solana’s main wallet, Phantom, went down for several hours during an airdrop by the Grass project. According to the team, the outage was caused by a backend issue.

On February 1, Phantom was down for about an hour and a half due to a DDoS attack. Additionally, there were three more backend-related incidents this year, during which the wallet was down for 2 to 8 minutes.

Is this a lot or a little? For a free product, two outages lasting more than an hour per year is actually very little — and certainly not enough to claim that Phantom «constantly goes down.»

3. Transaction Processing Issues

In April, crypto media widely reported that supposedly 75% of transactions on Solana were failing. This happened during the first wave of memecoin popularity. In reality, the vast majority of these failed transactions were submitted by arbitrage bots, essentially spam. The issue is that Solana’s network module (QUIC Network) isn’t yet fully optimized for spam control; this problem should be partially resolved with the launch of the Firedancer client.

What is Firedancer and how will it help Solana?

Each of the nearly 1,400 validators in the Solana network uses a client — a program that connects them to the blockchain, enables voting, and processes transactions. Around 69% of validators use the official client from Solana Labs, while the rest use an alternative client from JitoLabs (a fork of the original client). Soon, however, a third client will be available on the mainnet, developed by the renowned trading firm Jump Trading: Firedancer. It’s expected to bring several improvements to Solana’s performance:

- Maximum speed and reliability: Firedancer optimizes each process individually, including consensus, signature verification, memory management, and more.

- Support for up to 1 million TPS (transactions per second).

- Enhanced QUIC protocol implementation, which should address network overloads and freezes.

- Data compression, leading to faster data exchange between nodes.

- Reduced hardware requirements for validators, which could increase the number of validators, enhancing decentralization.

- Sharding support — although Solana doesn’t currently use sharding, it could help with scaling in the future, as seen with TON (we covered this in more detail in our article «How a 90s Idea Helped Scale Blockchain: Sharding in TON»).

For end users, the primary benefit of Firedancer is likely to be the elimination of network freezes and failed transactions. However, Firedancer won’t address issues related to wallets (especially Phantom) or dApps, as they operate on independent backends.

Firedancer is already live on testnet. The mainnet launch is tentatively expected in Q1 2025, but a specific date has yet to be announced.

Advantages of launching a project (even a tech project) on Solana

1. Large Active User Base and Excellent Liquidity

Solana outperforms all other blockchains in terms of active addresses, real transaction volume, and DEX trading volume. This is crucial for both token launches and scaling applications. For comparison, TON, despite the huge success of its casual games, ranks only in the third tier in terms of trading volume with $92 million per week, whereas Solana sees $15.7 billion in weekly trading volume.

2. Forums, Hackathons, and Grants

Projects on Solana have many opportunities to attract attention and funding:

- Grants and Investments from the Solana Foundation: Over 500 grants have been awarded, mainly in the «public goods» category (open-source projects with free products). The Solana Foundation also invests directly in commercial projects as a venture fund.

- Superteam Grants: Quick microgrants of up to $10,000, including opportunities for projects from Eastern Europe.

- Hackathons and the Colosseum Accelerator: Winners of online hackathons gain access to the accelerator and can also secure seed funding.

3. Interest from IDO Investors

Token sales on Solana through platforms like KuCoin Spotlight, Gate.io Startup, and Jupiter LFG raise significant funds. Over the last three months, IDOs for projects like Dojo Protocol, CARV, deBridge, Matrix One, Sanctum, and others have raised over a million dollars each — all of which are tech projects, not just meme tokens.

Source: CryptoRank

4. Relatively high speed and affordable fees

As mentioned, transaction finalization on Solana takes about 5-6 seconds—similar to TON. As for fees, they were around $0.035 at the end of October 2024 due to the memecoin hype, but in regular periods, they can be under $0.01, which is lower than TON’s fees ($0.025) but higher than those on Base, Blast, and other L2s (averaging around $0.003).

5. Development in Rust

The number of developers on Solana is growing thanks to the low barrier to entry: Rust is widely used outside of blockchain, unlike Solidity or the FunC language used in TON.

6. Chance to benefit from the Firedancer hype

The release of the Firedancer client in 2025 could have a similar impact to Ethereum’s The Merge upgrade — a wave of hype leading up to the event and a general increase in the value of Solana-based project tokens.

7. Protection against MEV attacks and front-running

So-called sandwich bots are a major issue on Ethereum DEXs. They manipulate transaction order in the mempool by «bribing» validators, profiting at the expense of other participants.

On Solana, there’s no mempool, and there’s no way to «pay extra» to have your transaction processed first. As a result, there are no sandwich bots on Solana, meaning token pricing will be more organic, and buyers won’t experience high slippage.

What to consider when launching a project on Solana

1. The «Meme» reputation of the chain

Be prepared to explain to investors why you chose Solana — many still see it as the chain «full of memes.» Hopefully, the arguments in this article will help you make your case.

2. A completely different technology compared to EVM

Development experience on Ethereum won’t be of much use here; you’ll need developers who specifically know Solana (and not just Rust—language knowledge alone isn’t enough).

3. A separate ecosystem

Also, keep in mind that Solana has its own ecosystem of DEXs (Jupiter, Raydium), wallets (Phantom), and launchpads (Solanium, etc.).

More popular articles

Mintless Jettons on TON: A New Feature Making TON Projects Even More Attractive

MetaLamp editorial team

L2 for Bitcoin: is it worth launching a project in the Stacks, Merlin Chain, Bitlayer, and other ecosystems

MetaLamp editorial team

UMA Protocol: How does the popular Optimistic Oracle work?

Pavel Naydanov

Solidity developer

Why Use Blockchain for Tokenizing Premium Alcohol

Elizaveta Chernaya

Brand Media Editor

CoW Protocol Batch Auctions: How Orderbook, Autopilot, and Solvers Ensure Fair Trading

Alexei Kutsenko

Solidity developer

CoW DAO and CoW Protocol: How Intent-Based Trading and MEV Protection Transform DeFi

Alexei Kutsenko

Solidity developer

Smart Contracts Aren’t Deployed Yet, but Addresses Already Exist: Why CREATE2 (EIP-1014) Matters

Roman Yarlykov

Solidity developer

How to Fork and Launch Uniswap V3 Smart Contracts: A Practical Guide

Alexei Kutsenko

Solidity developer

Bittensor: Overview of the Protocol for Decentralized Machine Learning

Alexei Kutsenko

Solidity developer

Aerodrome Protocol: How a MetaDEX on Base Blends Uniswap, Curve, and Convex

Roman Yarlykov

Solidity developer

Articles

Algebra Finance: Modular DEX-as-a-Service with Plugins, Dynamic Fees, and Uniswap Compatibility

Roman Yarlykov

Solidity developer

Articles

ERC-6909: Minimal Multi-Token Interface and Why It Matters for Ethereum Projects

Pavel Naydanov

Solidity developer

Uniswap v4 Explained: Hooks, Singleton Architecture, Dynamic Fees & ERC-6909

Pavel Naydanov

Solidity developer

AI Agents: How AI Agents Conquered the Crypto Market + Key Projects

MetaLamp editorial team

AI and Blockchain: Key Takeaways from 2024 and Industry Forecasts for 2025

MetaLamp editorial team

The main events in The Open Network (TON) ecosystem in 2024

MetaLamp editorial team

A Guide to EigenLayer: How the ETH Restaking Protocol Attracted $15 Billion TVL

MetaLamp editorial team

The Open Network 2025: figures, events, analytics, forecasts

MetaLamp editorial team

Overview of Blockchain Bridges: Interaction Between Different Networks

Roman Yarlykov

Solidity developer

5 Rules from the Founder: How an EdTech Project Can Attract Investments. The Case of the Online School “Logopotam”

Alexey Litvinov

CEO and founder of the online school Logopotam

Is it worth launching a project on Solana, despite the hype around memes?

MetaLamp editorial team

Mintless Jettons on TON: A New Feature Making TON Projects Even More Attractive

MetaLamp editorial team

3 reasons to choose a ready-made solution for mini-apps in Telegram instead of developing from scratch

Dmitriy Shipachev

CEO at Finch

Think of it like a hamster for traffic: how to attract an audience with a Telegram clicker game

Nico Bordunenko

Business Analyst at MetaLamp

Which Rollup to Choose for Your Project: Arbitrum, Optimism, Base, ZK EVM, and Others

MetaLamp editorial team

How We Adapted a Mobile RPG for Blockchain and Enabled NFT Sales

MetaLamp editorial team

How TON Payments Enable Fee-Free Micro-Transactions and Their Uses

MetaLamp editorial team

What You Need to Know Before Starting a Project on TON

MetaLamp editorial team

What is the Meaning and Benefits of MVP for Startups in 2024?

MetaLamp editorial team

RWA explained: Opportunities of Real-World Assets in 2024

MetaLamp editorial team

Creating a Crypto Transaction Widget for Google Sheets: The CPayToday Journey

MetaLamp editorial team

How Early-Stage Startups Can Stay on Track with Development

MetaLamp editorial team

How to Attract Investments: Insights from Successful 2023 Startups

Mykola Pryndiuk

Social Media Specialist

When and How to Find a Technical Partner for Your Startup

MetaLamp editorial team

Understanding the Necessity of Account Abstraction in the Crypto World

Pavel Naydanov

Solidity developer

Ways to Speed Up Development: Outstaffing Pros and Cons

MetaLamp editorial team

Freelancer, Agency, or Contract Employees: Who to Hire for Startup MVP Development

Yana Geydrovich

Partnership manager at MetaLamp

From Corporate Blog to Brand Media: The Birth of Metalamp Magazine

Mykola Pryndiuk

Social Media Specialist

La Migliore Offerta: The Impact of Cryptocurrency on Business and Economy in 2023

Roman Shtih

CEO Metalamp

How We Use Our Training Program to Recruit Plutus Engineers

Svetlana Dulceva

The Education Program Supervisor

Discover Why IT Companies Appreciate Our Junior Developers

Svetlana Dulceva

The Education Program Supervisor

How We Designed a No-Cost Education Program for Web Development

Sergey Cherepanov

CTO MetaLamp

Articles